GEMEINSAM ZUKUNFT DENKEN

Software- und Beratungs-

Lösungen für die Wohnungswirtschaft

Was Kunden über uns sagen

Kompetenzen nutzen!

Die Finanzierungsbedingungen werden anspruchsvoller. Da ist es gut, einen transparenten Marktüberblick und einen verlässlichen, kompetenten Partner an der Seite zu haben.

Ingeborg Esser

Hauptgeschäftsführerin GdW, Berlin

Alterssorgen – nicht bei uns!

Betriebliche Altersversorgung ist für uns ein wichtiges Thema, aber auch komplex. Gemeinsam mit unserem Versicherungsmakler Dr. Klein Wowi haben wir in rente 21 eine sichere und verständliche Versorgungslösung mit Sonderkonditionen gefunden.

Steffan Liebscher

Vorstand GEWOBA Nord, Schleswig

Nie wieder Überstunden machen!

Seit der Einführung von WOWIPORT haben wir keine Überstundenregelung mehr. Warum? Weil wir einfach keine Überstunden mehr machen!

Sebastian Niesen

Geschäftsführer Niesen Immobilien GmbH, Düsseldorf

Kundennah und zukunftsorientiert

Dr. Klein Wowi – lösungsorientiertes Consulting trifft den „Nerv der Zeit“. So lassen sich Herausforderungen mit Weitsicht meistern und „gemeinsam Zukunft denken“. Wir vertrauen hier ganz auf Dr. Klein Wowi.

Marko Dörsch

Vorstandsmitglied BG Selbsthilfe eG, Nürnberg

Was mich begeistert: Wir sprechen die gleiche Sprache!

Dr. Wowi Klein ist fachlich exzellent. Wir arbeiten seit vielen Jahren bei Finanzierung, Consulting und Versicherung zusammen. Das Miteinander, das proaktive Vorgehen, der Service und die praxisgerechten Lösungen sind einzigartig.

Norbert Winter

Vorstandsmitglied Bauhütte Heidelberg Baugenossenschaft eG

Updates sollten up-to-date sein!

Wir fragen uns noch heute: Warum war unser ERP-System so altmodisch wie Windows 98? Wir sehen doch, dass es auch anders geht!

Michael Hopp

Leiter Rechnungswesen / Prokurist Wohnungsgenossenschaft MERKUR eG, Berlin

Ein Blick durch die Risikobrille

Dr. Klein Wowi hat für uns einen Markt- und Zinsreport entworfen, mit dem wir Handlungsempfehlungen für Finanzierungsentscheidungen ableiten und dokumentieren. Er ist wichtiger Bestandteil unseres Risikomanagements.

Klaus Graniki

Geschäftsführer DOGEWO, Dortmund

Beständig, erfolgreich, innovativ

Dr. Klein Wowi überzeugt uns schon seit Jahrzehnten immer aufs Neue mit kreativen Lösungen und innovativen Ideen – wie aktuell in einem Dekarbonisierungs-Projekt. Hohe Kompetenz, Schnelligkeit und Freundlichkeit – das ist Dr. Klein Wowi. Macht weiter so!

Sönke Selk

Vorstandsmitglied Baugenossenschaft Hamburger Wohnen eG

In der Service-Oase angekommen!

Bei WOWIPORT habe ich persönliche Ansprechpartner, die sich sofort um unsere Anliegen kümmern!

Alexander Theel

Leiter Rechnungswesen, Prokurist Wohnungsgenossenschaft DPF eG, Berlin

Viel persönliches Engagement und digitale Lösungen

Für unsere Unternehmensplanung nutzen wir WOWICONTROL. Bei unserer Finanzierungs- und Beleihungsplanung vertrauen wir somit auf innovative Software und kompetente Beratung von Dr. Klein Wowi. Diese Kombination macht es für uns aus!

Karin Autenrieth

Vorstandsmitglied Bau- und Heimstättenverein Stuttgart eG

Überzeugend. Wirkungsvoll.

Von der Bestandsaufnahme über die Strategieentwicklung bis hin zum Finanzierungsabschluss mit Topkonditionen erleben wir Dr. Klein Wowi als durchsetzungsstark, eng begleitend und sehr kundenorientiert. Auch die Kommunikation passt perfekt – eine überzeugende und wirkungsvolle Geschäftsbeziehung.

Thomas Bruns

Geschäftsführer Herner Gesellschaft für Wohnungsbau mbH

Ohne Barrieren. Ohne Probleme!

Arbeiten mit WOWIPORT ist so einfach, wie eine Anzeige bei eBay aufzugeben!

Marc André Naust

Vorstand Bau- und Siedlungsgenossenschaft Iserlohn eG

Mit Sicherheit Freiraum schaffen!

Wir optimieren mit Dr. Klein Wowi laufend unsere Finanzierungen und Sicherheiten. Eine wesentliche Grundlage für unsere Investitionen. Dadurch sehen wir uns sehr gut positioniert.

Matthias Schweizer

Geschäftsführer Wohnbau Bonn GmbH

Immer aktuell mit Impulsen aus dem Finanzierungsmarkt

Die Angebote von Dr. Klein Wowi erweitern unser Finanzierungsspektrum. Sie ergänzen die Handlungsfreiheit, die wir brauchen und stärken unseren Marktüberblick.

Uwe Eichner

Vorsitzender der Geschäftsführung Vivawest Wohnen GmbH, Essen

Einfach zu lernen, einfach zu bedienen!

Wir wollten nicht beim Vertriebspartner des großen Namen wegen bleiben, der eben nicht dieses Grundverständnis für das System mitgebracht hat.

Britta Wurm

Vorständin Baugenossenschaft Wolfratshausen eG

Die machen’s anders — und das ist sehr gut.

Als Banker sind Finanzen mein Steckenpferd. So vertraue ich nicht nur bei unserer Unternehmensplanung immer wieder auf Dr. Klein Wowi als kompetenten und kreativen Sparringspartner. Und Versicherungen können die auch!

Oliver Kulpanek

Vorstandsmitglied Baugenossenschaft Esslingen eG

1a-Beratung, top Teamwork

Wir lassen Dr. Klein Wowi alle paar Jahre über unsere Grundbücher schauen und unsere Darlehens- und Sicherheitenportfolios immer weiter optimieren. Die tolle, vertrauensvolle Zusammenarbeit gibt uns Sicherheit und steigert unsere Flexibilität.

Guido Esseln

Geschäftsführer Gemeinnützige Siedlungs-Gesellschaft mbH, Neunkirchen

Einfaches Arbeiten dank Automatisierung!

Wenn ich jetzt sehe, wie schnell wir mit der Buchhaltung sind, so schnell sind wir vorher nie gewesen. Die automatische Erkennung von Rechnungen klappt einfach, es nimmt uns so viel Arbeit ab.

Birgit Bendix-Bade

Geschäftsführerin Eilenburger Wohnungsbau- und Verwaltungsgesellschaft mbH

Unser Rundum-Sorglos-Paket

Wir haben Dr. Klein Wowi das Versicherungsmandat vor über 15 Jahren erteilt und profitieren seitdem von effektiver Schadenabwicklung und kompetenter Beratung. Für Immobilieninvestitionen erhalten wir on-top die passenden Finanzierungen. Ein Rundum-Sorglos-Paket, das begeistert.

Dirk Backhausen

Vorstandsvorsitzender Allertal Immobilien eG

Finanzierungen verlässlich, konzentriert und Volltreffer

Wir wissen, dass wir durch Dr. Klein Wowi einen versierten Blick auf den gesamten Kapitalmarkt erhalten und auch das Kleingedruckte in unseren Vertragsbedingungen für uns passt: super Vorbereitung, konzentrierte Arbeit und jedes Mal ein Volltreffer. So mögen wir das.

Dirk Miklikowski

Geschäftsführer Immobilien Management Essen GmbH

Die OPENWOWI – Schnittstelle hat die Entscheidung gebracht!

Die offene Schnittstelle war der Hauptgrund für unseren Wechsel zu WOWIPORT. Wir wollten unsere selbst entwickelten Lösungen ans ERP-System anbinden, das war beim Vorgänger unmöglich.

Jan Hische

Vorstand WBG Lünen

Unser Hafen für Finanzen

WOWICONTROL als zentrale Unternehmensplanung mit Investitionsrechnung ermöglicht es uns, Finanzierungsbedarfe zu erkennen, zu planen und fortzuschreiben. Wir haben alles im Blick und sind revisionssicher aufgestellt. Wir sind sehr zufrieden!

Anja Ronneburg

Vorstandsmitglied WBG 1903 Potsdam eG

Komplexe Versicherungsthemen verständlich erklärt

Seit wir Dr. Klein Wowi das Maklermandat erteilt haben, können wir sicher sein, dass all unsere Versicherungsthemen in kompetenten Händen liegen und sich unsere Ansprechpartner proaktiv kümmern.

Stefanie Höhl

Vorstandsmitglied Bauhütte Heidelberg Baugenossenschaft eG

Immer ein verlässlicher Partner!

Auch in schwierigen Zeiten ist uns Dr. Klein Wowi ein vertrauensvoller, verlässlicher Partner mit einem breiten Marktüberblick und kompetenten, zuverlässigen Ansprechpartnern mit großem Fachwissen.

Udo Bartsch

Vorstand Eisenbahner Bauverein, Düsseldorf

Traditionell und innovativ: eben hanseatisch…

Dr. Klein Wowi unterstützt schnell und verlässlich. Unsere Genossenschaftsstrategien fließen bei allen Konzepten mit ein. Kontinuität in der Betreuung und kompetente Ansprechpartner ohne Wenn und Aber – eben hanseatisch. Das passt zu uns.

Thorsten Möller

Leiter Unternehmensfinanzierung altoba eG, Hamburg

Finanzmarkt Wohnungswirtschaft – auf den Punkt gebracht!

Eine Stunde mit aktuellen und konkreten Informationen zu Finanzen und Finanzierungen in der Wohnungswirtschaft. Zeit, die ich mir jedes Quartal gerne für den Online-Vortrag von Dr. Klein Wowi freihalte!

Thomas Becker

Leiter Finanzen Vivawest Wohnen GmbH, Essen

Keine Lösungen von der Stange

Bei Dr. Klein Wowi gibt es nichts von der Stange. Wir bekommen maßgeschneidert die Vielfalt des Marktes – egal ob bei Finanzierungen, im Consulting oder im Versicherungsbereich. Das Vertrauen in Dr. Klein Wowi ermöglicht uns Wachstum und Freiheit – das wissen wir sehr zu schätzen.

Thomas Bauer

Vorstand Bau AG Kaiserslautern

Einfach Premium: 100 Prozent Qualität

Als Premium-Partner erhalten wir jederzeit eine ganzheitliche Beratung – eine sehr vertrauensvolle und bereichernde Betreuung. Die Wirtschaftlichkeit von Bauvorhaben macht uns Dr. Klein Wowi dabei durch Investitionsrechnungen transparent.

Dennis Voss

Vorstand Wohnungsbaugenossenschaft KAIFU-NORDLAND eG, Hamburg

rente21 für unsere Mitarbeiter

Uns ist wichtig, unseren Beschäftigten eine gute zusätzliche Altersvorsorge zu bieten. Durch Dr. Klein Wowi und deren Kooperation mit dem Branchenversorgungswerk „rente21“ sind wir dazu gut beraten und aufgestellt. Dr. Klein Wowi vermittelt kompetent und berät fallbezogen.

Michael Henseler

Geschäftsführer EWG Hagen eG

Klare Worte. Große Taten.

Wenn unsere Ansprechpartner von Dr. Klein Wowi die Köpfe zusammenstecken, eröffnen sich immer neue Perspektiven. Klare Worte von mir: Namensvetter durch Zufall, Geschäftspartner aus gutem Grund.

Dr. Jürgen Klein

Vorstandsvorsitzender Wohnungsbaugenossenschaft Friedrichshain eG, Berlin

Ein verlässlicher Partner an unserer Seite

Dr. Klein Wowi ist für uns ein strategischer Partner, der stets eine optimale Finanzierungsform für unsere Projekte findet und durch Optimierung der Sicherheiten und des Darlehensportfolios bestmögliche Konditionen erreicht.

Olaf Klie

Vorstand BG Dennerstraße-Selbsthilfe eG, Hamburg

Gemeinsam Wellen reiten

Wellen von Neubau- und Modernisierungsanforderungen kamen in den letzten Jahren auf uns zu, auch Zukäufe waren ein großes Thema. Dr. Klein Wowi hatten wir als kreativen Impulsgeber und verlässlichen Umsetzer bei Finanzierungen und Versicherungen immer mit an Bord.

Dr. Stephan Seliger

Vorstandsvorsitzender Genossenschaftliches Wohnungsunternehmen Eckernförde eG

Solide und smart

Mit großer Überzeugung arbeiten wir seit rund 15 Jahren vertrauensvoll mit Dr. Klein Wowi zusammen. Die Optimierung des Darlehensportfolios und ein cleveres Beleihungsmanagement im Vorfeld von Finanzierung haben sich immer gelohnt. Dr. Klein Wowi, ihr seid eine echte Bereicherung.

Christian Petersohn

Vorstandsvorsitzender Wohnungsgenossenschaft Kleefeld-Buchholz eG

Das Zünglein an der Waage

Sie schaffen es immer wieder gut, die Waage zwischen oft komplexen Anforderungen der Kreditinstitute und unseren Erwartungen auszutarieren. Hervorragenden Branchenkenntnisse und Kontakte, ganzheitliche Betreuung – das ist Dr. Klein Wowi.

Thomas Nebgen

Vorstandsvorsitzender GBS Genossenschaft für Bau- und Siedlungswesen eG, Hückeswagen

Dynamisch, charismatisch, zielstrebig!

Unsere intensive Verbindung zu Dr. Klein Wowi basiert auf einer vertrauensvollen und zielstrebigen Zusammenarbeit über viele Projekte und Ebenen hinweg. Gemeinsam optimieren wir z.B. stetig unsere Sicherheiten und haben somit unsere Beleihungsfreiräume immer im Blick.

Daniel Hacker

Vorstandsmitglied Neue Rostocker WB eG

News

Rückblick auf die erste WOWIPORT user conference 2024

Das Team der Dr. Klein Wowi Digital AG blickt mit…

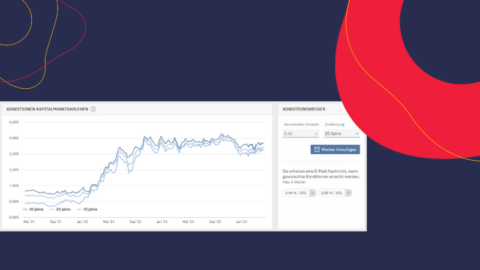

Update Zinsentwicklung und Top-Konditionen

Monatliches Update der Finanzierungs-Konditionen für Wohnimmobilien mit Zinskommentar unseres Vorstands

Neuer Konditionen-Wecker: Jetzt bei Wunsch-Zinssatz benachrichtigen lassen

Seit Mitte März hat Dr. Klein Wowi in WOWIFIN, dem…

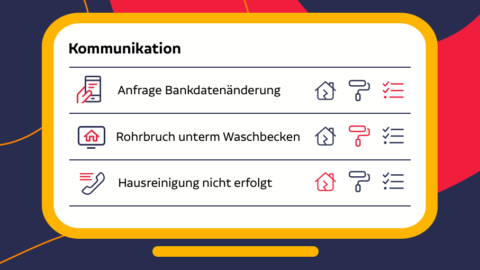

Das neue Nachrichtencenter – die Kommunikationszentrale direkt in WOWIPORT

Das neue Nachrichtencenter – die Kommunikationszentrale direkt in WOWIPORT

KfW: Neue Mittel für Wohnungsneubau – wie lange noch & ab wann stehen Mittel für ein neues Programm zur Verfügung?

Seit dem 20.02.2024 steht das Programm „Klimafreundlicher Neubau“ (KFN) wieder…

Cyber-Risk – Der GDV aktualisiert seine Musterbedingungen

Guido Rausch, Leiter Versicherung bei Dr. Klein Wowi, gibt einen…

wowiconsult und WOWICONTROL arbeiten zusammen

Hand in Hand für die Dekarbonisierung der Wohnungswirtschaft: Mit der…

Hohe Investitionen über lange Planungszeiträume: Herausforderungen in der Unternehmensplanung

Ines Cumbrowski, Senior-Consultant bei Dr. Klein Wowi, beschreibt, warum es…